- Hindi News

- Business

- India’s New Income Tax Act 2025: No Tax On Income Up To ₹12 Lakh Starting April 2026

New Delhi18 minutes ago

- copy link

The central government is going to implement a new income tax law (Income Tax Act, 2025) in the country from April 1, 2026. The new law will replace the old law that has been in place since 1961. The biggest objective of the new law is to simplify the tax process and reduce complications for the common man.

Under the new rules, now the salaried class will not have to pay any tax on annual income up to ₹ 12 lakh. Apart from this, difficult words like ‘Assessment Year’ and ‘Previous Year’, which were used till now for filing tax, will be removed and now only ‘Tax Year’ will be used.

Major changes in 6 decade old law

Now there will be only 536 streams instead of 819.

The current Income Tax Act was made in 1961, which has been amended several times till now. Because of this it had become quite complicated. The government has reduced the number of sections in the new law from 819 to 536. Its language has been kept so simple that even a common taxpayer can understand how much tax he has to pay and which forms he has to fill. The number of chapters has also been reduced from 47 to 23.

Earnings up to ₹12.75 lakh are tax free

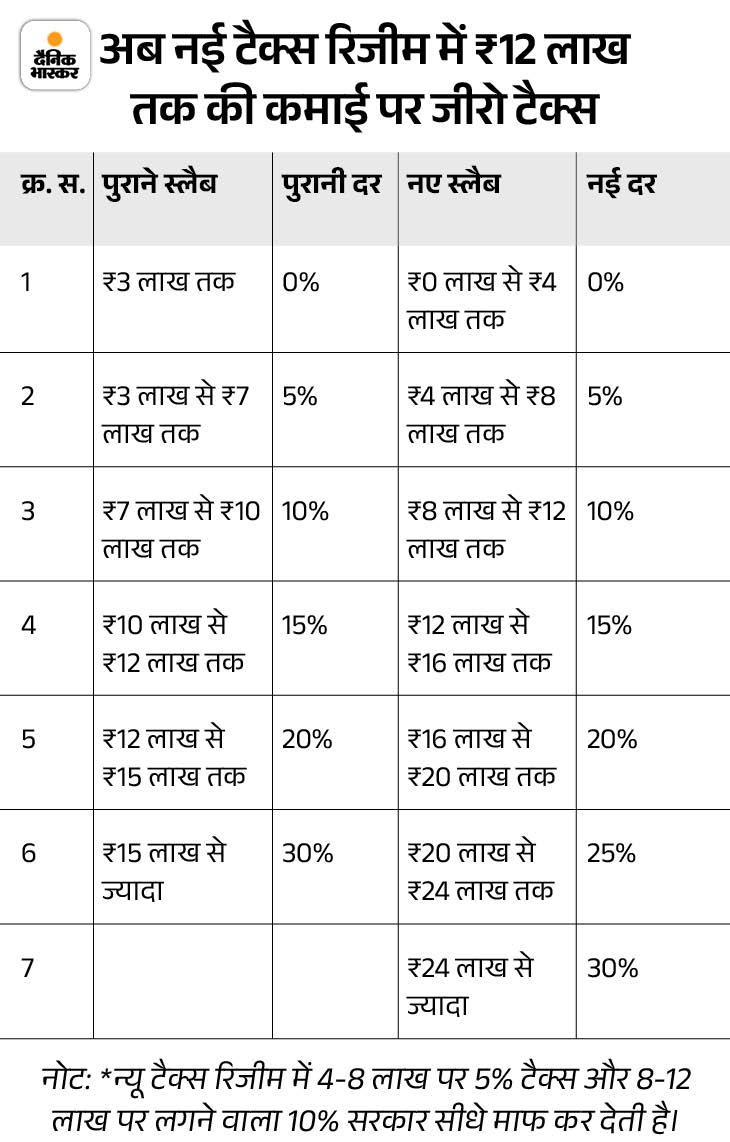

Under the new tax regime, there will now be zero tax on earnings up to ₹ 4 lakh. After this, the exemption has been increased to ₹60,000 on income up to ₹12 lakh. This means that if your annual income is ₹ 12 lakh, then after getting the rebate you will not have to pay even Rs 1 tax. If standard deduction of ₹ 75,000 is also added to this, then salary up to ₹ 12.75 lakh will be completely tax free.

Now tax year instead of assessment year

Till now, taxpayers were confused between ‘Previous Year’ (year in which money was earned) and ‘Assessment Year’ (year in which tax was paid). Both of these have been abolished in the new law. Now there will be only ‘tax year’. That means, the year in which you earn will be called your tax year. This has been done as per global standards so that transparency is maintained in tax filing and calculation.

Emphasis on digital and faceless system

The new law is completely based on digital-first approach. Faceless assessment has been strengthened so that the taxpayer and the officer do not come face to face and the scope for corruption is eliminated.

Recently, the government has rejected the news going on social media that the department will check everyone’s email or social media accounts. The government has made it clear that this will be done only in cases of serious tax evasion.

Joint tax filing for married people

For Budget 2026, ICAI has suggested that married couples in India should get the option to file tax returns jointly. This will benefit those families where only one member earns. Although the government has not yet taken a final decision on this, it is believed that this can be considered to provide relief to the middle class.

——————–

Here you can calculate your tax…

Source link

[ad_3]